The Display Landscape of Mini- and MicroLEDs

First there was LED (light emitting diode) display technology, commercialized in 1994. OLED (organic LED) products came on the market in 1997. Then microLEDs began to emerge in 2010. And now we’ve been hearing about a new display technology category: miniLEDs, poised to enter the market in 2019.1

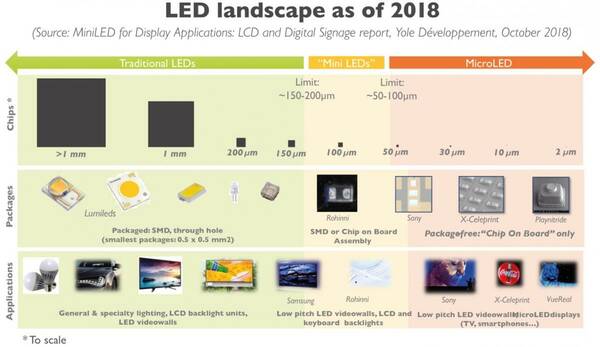

As the name would imply, a miniLED is small—but not as small as a microLED (µLED). While there are no official definitions, microLEDs are typically less than 50 micrometers (µm) square, with most falling in the 3–15 µm size range. Generally, the term miniLED (sometimes also called "sub-millimeter light emitting diodes") refers to LEDs that are roughly 100 µm square (0.1 mm square), although “mini” can also simply describe any LED between micro and traditional size.

LED landscape as of 2018. Image Source: "MiniLED for Display Applications: LCD and Digital Signage" report by Yole Développement, October 2018.

Though they share many similarities, miniLEDs and microLEDs are also different in some key ways. MicroLEDs are not just shrunken versions of their miniLED sisters. The two LED types have different performance and structures. LEDinside characterized the difference as follows: “Micro LED is a new-generation display technology, a miniaturized LED with matrix. In simple terms, the LED backlight is thinner, miniaturized, and arrayed, with the LED unit smaller than 100 micrometers. Each pixel is individually addressed and driven to emit light (self-emitting), just like OLED...Mini LED is a transitional technology between traditional LED and Micro LED, and is an improved version of traditional LED backlight.”2

Additionally, a driving factor in the recent emergence of miniLEDs is that they are less expensive to produce, largely because current fabrication facilities can more quickly be switched over to miniLED production. MiniLEDs are essentially a variation of already mature LED technology.

MicroLED Fabrication Challenges

MicroLEDs are typically made from Gallium-nitride-based LED materials, which create brighter displays (many times brighter than OLED) with much greater efficiency than traditional LEDs. This makes them attractive for applications that need both brightness and efficiency such as smart watches, and particularly for head-up displays (HUDs) and augmented reality systems that are likely to be viewed against ambient light backgrounds

OLED screen manufacturing has been somewhat costly to date, limiting its adoption primarily to smaller screen sizes like smart phones. Likewise, producing an entire television screen out of microLED chips has so far proven to be challenging. MicroLEDs require new assembly technologies, die structure, and manufacturing infrastructure. For commercialization, fabricators must find methods that yield high quality with microscopic accuracy while also achieving mass-production speeds. For starters, a miniLED backlight screen may be made up of thousands of individual miniLED units; a microLED screen is composed of millions of tiny LEDs.

To fabricate a display, each individual microLED must be transferred to a backplane that holds the array of units in place. The transfer equipment used to place microLED units is required to have a high degree of precision, with placement accurate to within +/- 1.5 µm. Existing pick & place LED assembly equipment can only achieve +/- 34 µm accuracy (multi-chip per transfer). Flip chip bonders typically feature accuracy of +/-1.5 µm—but only for a single unit at a time. Both of these traditional LED transfer methods are not accurate enough for mass production of microLEDs.

New transfer solutions are under development, including fluid assembly, laser transfer, and roller transfer. Researchers are also working to resolve the challenges associated with integrating compound semiconductor microLEDs with silicon-based integrated circuit devices that have very different material properties and fabrication processes. Traditional chip bonding and wafer bonding processes don’t provide efficient mass transfer for microLED, so various thin-film-transfer technologies are being explored.

Despite Samsung’s introduction of a prototype 75-inch microLED television at the recent CES show (below), microLED products are not expected to reach the general market until 2021.3

Han Jong-hee, president of Samsung Electronics's video display business, introduces a new 75-inch microLED TV in Las Vegas on January 6, 2019. Photo Source: Business Korea

MiniLED Advantages

By contrast, miniLED chips do not present similar production complications. Because they are just smaller versions of traditional LEDs, they can be manufactured in existing fabrication facilities with minimal reconfiguration. This ease means miniLED production is already underway and devices will reach the market this year for applications in gaming displays and signage, followed by backlight products such as smartphones, TVs, virtual reality devices, and automotive displays.

For example, miniLEDs can be used to upgrade existing LCD displays with “ultra-thin, multi-zone local dimming backlight units (BLU) that enable form factors and contrast performance”4 that rival the quality of OLED displays. MiniLEDs also have an advantage as a cost-effective solution for narrow-pixel-pitch LED direct-view displays such as indoor and outdoor digital signage applications.

MiniLED backlight television from Chinese manufacturer TLC displayed at CES 2019. Photo Source: FlatpanelsHD.

MicroLEDs do offer high luminous efficiency, brightness, contrast, reliability and a short response time, but they are likely to be priced at more than three times traditional LED screens during initial the initial stages of mass production. MiniLEDs, while they perform more like traditional LEDs, do have advantages when it comes to HDR and notched or curved display designs, and could launch at just 20% above standard LCD panel prices.5 According to PCWorld, “at this stage, the biggest difference between microLED and miniLED for consumers is that microLED is likely to make it to market as a fully-fledged next-generation display technology of its own while miniLED is likely to mostly be used by manufacturers to enhance existing display technologies.”6

Together, microLEDs and miniLEDs are expected to have roughly equal shares of a $1.3 billion market by 2022.7

Quality Assurance for All LED Types

Whether LED or OLED, micro- or mini-, LED display products of all types are jostling for room in a highly competitive marketplace, where customers expect a perfect viewing experience right out of the box. Defects, variations in color or brightness, and other irregularities can quickly deflate buyer satisfaction, hurt brand reputation, and erode market share.

To ensure the absolute quality of OLED- and LED-based devices, Radiant’s ProMetric® Imaging Photometers and Colorimeters measure display performance and uniformity down to the pixel and subpixel level, matching the acuity and discernment of human visual perception.

CITATIONS:

- YiningChen, “Mini LED Applications to be Launched in 2019 and Micro LED Displays in 2021.” LEDinside, October 19, 2018. LINK

- Evangeline H, “Difference between Micro LED and Mini LED.” LEDinside, May 8, 2018. LINK

- YiningChen, “Mini LED Applications to be Launched in 2019 and Micro LED Displays in 2021.” LEDinside, October 19, 2018. LINK

- "MiniLED for Display Applications: LCD and Digital Signage" report by Yole Développement, October 2018, as reported in “Mini-LED adoption driven by high-end LCD displays and narrow-pixel-pitch LED direct-view digital signage”. Semiconductor Today, November 28, 2018. LINK

- Evangeline H, “Difference between Micro LED and Mini LED.” LEDinside, May 8, 2018. LINK

- Halliday, F. “MicroLED vs Mini-LED: What’s the difference?” PCWorld, September 11, 2018. LINK

- YiningChen, “Micro LED & Mini LED Market Expects Explosive Business Opportunities, with an Estimated market Value of $1.38 Billion by 2022”. LEDinside (a division of market research company TrendForce), June 20, 2018. LINK

Join Mailing List

Stay up to date on our latest products, blog content, and events.

Join our Mailing List