As the Display Industry Booms, Radiant Expands Production

As displays and devices continue to increase their presence in our homes, workplaces, commercial venues, and public spaces, display manufacturing activity has increased proportionally. For example, global flat-panel display production capacity has grown from an estimated 231 million square meters (sq m) in 2017 to an anticipated 327 million sq m by the end of 2022,1 an increase of 70%.

As devices are manufactured, they require quality testing before they can be shipped to market. To better serve expanding world-wide display production activity and provide the associated quality testing solutions, Radiant has expanded its own production footprint, recently opening a manufacturing and technical support facility in Suzhou China.

The Booming Display Market

Multiple forces are driving display market growth:

- Ongoing consumer adoption of smartphones, tablets, and other smart devices, especially in still emerging economies in the APAC, MENA, and LATAM regions

- Increasing industrial, educational, and healthcare use of augmented/mixed reality headset displays and smart glasses

- The proliferation of digital signage and video walls in retail stores, sporting and event facilities, and for mass transit applications

- Increasing use of touchscreen and interactive displays, from grocery-store self-checkout to smart home appliances, to wayfinding kiosks in tourist destinations

A few examples of the vast number and variety of displays all around us today.

Additionally, the COVID-19 pandemic has contributed to rising demand for medical devices with integrated displays, such as respirators and ventilators, and an increase in laptop and monitor sales as more people have set up home offices for remote work. Industry analysts and research consultancies are predicting an onward march of displays in the coming years:

- The total global display market is expected to grow from roughly US$148.4 billion in 2021 to US$177 billion in 2026, a CAGR (compound annual growth rate) of 3.6%2

- One of the fastest-growing segments is the AR/VR display market, which includes both AR/VR/MR (collectively, XR) devices and augmented-reality head-up displays (HUDs). From worldwide revenues of roughly US$736 million in 2020, this segment is expected to grow at a CAGR of 36% through 20273

- The large-format display market is growing at an annual rate of 7.2% and is forecast to increase from US$13.1 billion in 2021 to US$18.6 bn by 20264 with indoor installations taking the lead

- Similarly, smartphones sales are growing at a 6.85% CAGR through 2026, with 5G capability and foldable/flexible models helping to drive replacement cycles among current users alongside increasing penetration in emerging markets.5

- The laptop, tablet, and desktop computer market, meanwhile, is poised to reach US$206.9 bn in 2026, expanding at a rate of 9.68% CAGR.6

- Television sales also continue to rise, as newer OLED, mini/micro-LED, and quantum-dot-based technologies keep offering consumers higher resolution displays with brighter and more vivid images, and better contrast and view angle performance.7

The television display market by type of display technology (as a percentage of total units sold), from 2018 to today and forecast through 2025. (Source: Omdia)

The Challenge of Emissive Display Quality

With displays finding their way into so many areas of life, manufacturers strive to meet the growing demand while delivering the quality and performance that customers have come to expect. To do this, they must continue to expand and evolve their display measurement and inspection regimens at all stages of the production process.

Emissive display pixel pattern measurement (taken using Radiant Microscope Lens and TrueTest™ Software)

Typically, backlit displays are inspected to ensure a uniform appearance across the panel—meaning consistent brightness and color and an absence of noticeable defects (called mura). Because the light source in these cases is provided by an array of LEDs behind an LCD screen, individual variations between are less obvious because the light from each LED blends together as viewed through the screen.

With newer emissive display types, however, there is no LCD layer. Individual OLED or microLED pixel-to-pixel variations are more noticeable to the human eye, increasing inspection complexity. Each of the individual pixels can exhibit wide variation in luminance and chromaticity. Manufacturers now require inspection systems capable of very high-resolution measurement to capture precise pixel and subpixel detail.

In particular, new emissive display types such as OLED, microLED, and microOLED present different quality inspection challenges than earlier technologies such as backlit LCDs. Each pixel of an emissive display is its own light source—an individual emitter. Each emitter typically includes several tiny subpixel elements (such as red, green, and blue diodes).

Magnified image of microLED pixels, showing variability that can affect the customer’s perception of image and display quality if not corrected in production.

Radiant’s ProMetric® Imaging Photometers and Colorimeters are proven measurement systems for accurate, high-resolution display inspection—at production line speeds. With our TrueTest™ Software (including modules for AR/VR, HUD, and automotive displays) and specialized lenses for view angle measurement and other applications, Radiant solutions have enabled major consumer electronics brands to inspect millions of display devices to achieve visibly perfect performance.

Our systems not only measure defects but enable manufacturers to correct the uniformity of emissive displays such as OLED and microLED by applying our patented demura methods (demura = to remove mura). These corrected displays can then be sold instead of discarded, increasing production yields.

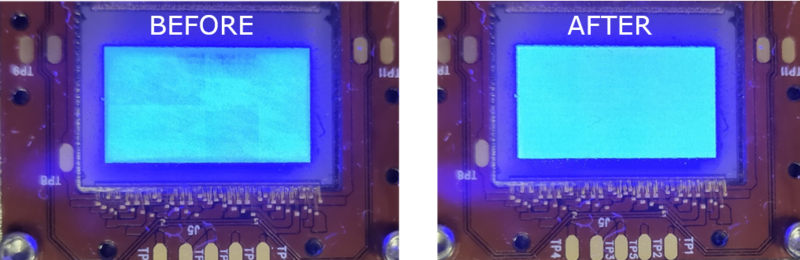

A microLED display before and after measurement and correction using Radiant’s ProMetric system and patented demura method. (Image © Jasper Display Corp.)

Stepping Up to Meet Global Production Demands

China has risen rapidly to become the superpower of manufacturing and is now the world’s largest manufacturer of displays, producing more than 40% of the global supply.7 Recognizing the importance of the Chinese technology sector, Radiant has long provided in-country application engineering, support, and sales—we opened our very first China office in Shanghai in early 2012.

A decade later, we are excited to share news of the first Radiant production facility China. Located in Suzhou, our new office and factory includes a full cleanroom for manufacturing, service, and repair of our ProMetric® cameras. Opened in 2021, the facility allows us to provide faster delivery of new, made-in-China systems to customers in the region. It also enables rapid turnaround for support requests, as China-based customers no longer have to ship their equipment back to the US for recalibration and other services.

The new clean room in Radiant’s Suzhou, China factory increases our product manufacturing capacity and our ability to quickly address service and maintenance requests from regional customers.

Having two production operations—one in China and one in Redmond, WA—also gives Radiant resilience in the face of any potential disruptions due to COVID-19 or other events. To learn about Radiant’s display inspection systems for smartphones, televisions, and computing devices, our AR/VR display measurement solutions, and our new facility in China, watch the video, Visibly Perfect: Test & Correction Solutions for MicroLED, OLED, and other Displays.

CITATIONS

- Global production capacity for flat panel displays (FPD) from 2017 to 2022 (in million m2), by type. Statista. Retrieved March 10, 2022.

- Display Market with COVID-19 Impact Analysis by Product (Smartphones, Wearables, Television Sets, Signage, Tables), Resolution, Display Technology (LCD, OLED, Direct-View LED, Micro-LED), Panel Size, Vertical, and Geography – Global Forecast to 2026. Markets and Markets, February 2021.

- "Extensive use of AR and VR in the Healthcare Sector Boosting the Growth of the AR and VR Display Industry.” From Global AR and VR Display Market: By Type: HMD, HUD, Projector; By Technology: Augmented Reality (AR), Virtual Reality (VR); By Applications: Commercial, Automotive, Healthcare, Others...Forecast (2017-2027); Market Dynamics; Competitive Landscape; Industry News and Developments, report by Expert Market Research. Retrieved March 10, 2022.

- “Surging large format display market to reach $18bn by 2026.” Markets and Markets report: Large Format Display Market with COVID-19 Impact Analysis by Offering, Type, Technology (Direct-View LED, LED-backlit LCD), Size, Brightness, Installation Location, Application (Retail, Hospitality, Sports, Education), Region – Global Forecast to 2026.

- Global Smartphone Market Research Report - Segmentation By Operating System (Android, iOS, Others); Distribution Channel (OEM, Retail, E-Commerce), and Geography - Forecast and Analysis 2022 to 2027. Report by Market Data Forecast, January 2022.

- Global Computer Market 2022-2026. Report by Technavio, January 2022.

- Kim Eun-jin, “China is Now the Top Player in the Global Display Industry.” Business Korea, July 26, 2021.

Join Mailing List

Stay up to date on our latest products, blog content, and events.

Join our Mailing List